Open-Banking Solutions

Open banking is a service model that allows financial institutions to authorise their customers to share their financial data with third-party providers. It enables lenders to check credit standing, or online merchants to verify payment histories, or businesses to check the identity of prospective customers and employees faster and more accurately.

Customers can be advised according to their needs based on this data. This simple and fast solution improves customer loyalty and customer satisfaction. At the same time, maximum security is guaranteed in terms of identity, credit standing, and data protection. The information acquired includes account information, transactions, proof of identity, and other financial data of the customer concerned.

Open-banking solutions

Real estate

Using AccountCheck, properties can be rented or sold to the perfect tenant or buyer in no time and with little effort.

eCommerce

Online retailers offer a wide range of payment options. Adapt them to the needs of your customers. Whether through ‘purchase on account’ or a ‘SEPA direct debit mandate’.

Mobility

Rapidly changing consumer behaviour in the automotive industry is giving rise to new financing models. Effective advice based on AccountCheck information will help to improve you customer’s experience.

Use Case Subscription Model

Trends show that consumers are attaching increasing importance to freedom and flexibility when it comes to their possessions. The subscription model offers businesses a secure and predictable source of income.

Banking & Finance

Thanks to the digitalisation of the application and verification process, loans can be granted quickly, accurately, and conveniently.

Further use cases

Besides the use cases already mentioned, AccountCheck can also be easily integrated in other areas.

Use case: Real estate

It’s important to be able to make quick decisions on creditworthiness when renting or selling real estate. An AccountCheck can be used to start a digital application process. Interested parties can consent to complete this process in three steps.

It takes just a few minutes to verify compliance with the rent-to-income ratio. The account data can also be used to determine the maximum permitted rent and ideal debit period.

When a property needs to be financed, compliance with the new OeNB guidelines is important. They can be checked directly in AccountCheck without requiring a lot of paperwork.

Use Case: Mobility

When purchasing a car, the buyer must decide not only on the model but also on the type of financing to use.

Anytime a consumer wants to finance a car, lease it, or take out a subscription, his or her creditworthiness and ability to pay are key factors.

An AccountCheck simplifies the financing and decision-making process for everyone involved. The account analysis provides quick and accurate information on a daily basis that will help to determine whether a subscription model, leasing, or financing meets the needs of the prospective car user.

AccountCheck can be used to help find the perfect car with the right financing for the right customer.

Use Case: eCommerce

Online retailers offer their customers a wide range of different payment options. However, the wrong choice can quickly lead to a customer defaulting on payment.

Internet anonymity can quickly prove fatal for an online retailer. By ensuring simple process integration in the online store system, a buyer’s identity and ability to pay can be checked early on while he or she is completing their order during check-out. As a result, payments can be individually adjusted to the customer's needs. It takes one click to set up a SEPA direct debit mandate or to offer the customer the ‘purchase on account’ option.

Simple process integration will enhance the customer’s experience and thus boost conversion rates.

Use case: Subscription model

In their drive towards digitalisation, many innovative companies are introducing subscription services. For them, this business model means stable monthly sales.

It’s a business model that brings companies strong customer loyalty. For customers, it means flexibility and freedom of ownership, as well as cost savings.

Subscription service providers can use AccountCheck to verify their customer's ability to pay, determine the ideal debit period, and set up a SEPA direct debit mandate based on the customer’s bank details all in one single step.

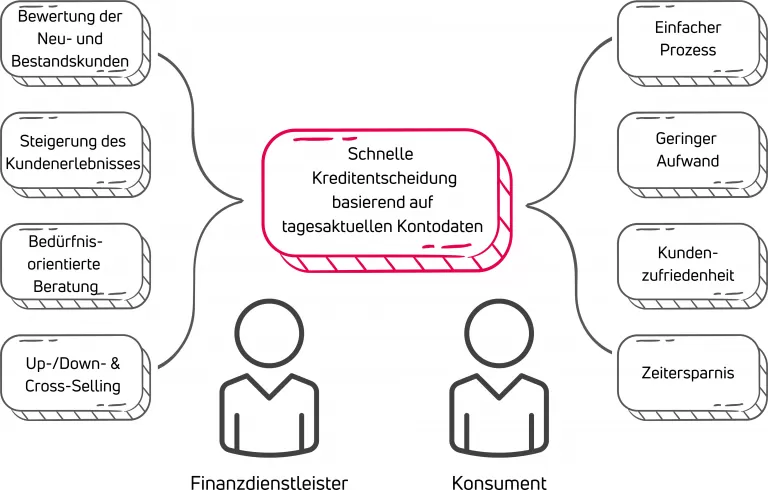

Use case: Banking & finance

AccountCheck gives lenders and financial institutions a quicker and more accurate tool to check the credit standing of prospective customers. The analysis is based on a wide range of information, from (categorized) raw data to the household budget. What’s more, bank account verification minimises the risk of fraud. And there’s another important aspect: only a few manual checks are needed, which accelerates and simplifies the credit application process. Customers benefit from the easy and quick credit decision. With AccountCheck, granting loans becomes a quick and hassle-free process that can be completed from one’s home.

Further use cases

Because AccountCheck has access to financial data, it can be used for much more than just a credit check. Identity verification and fraud prevention are additional benefits an AccountCheck offers. Thanks to SAP integration, the master data and your customer’s account information can be compared.

In HR, an identity check based on AccountChecks can be used to verify the identity of applicants and employees before they are granted access to the company’s restricted areas. Furthermore, employees have the option of updating their account data independently and in their own time via a self-service portal. This can contribute to the company’s security and integrity and minimise the potential risk of payroll scams.

POS use case

Have you ever thought about giving your customers the option of making 'purchases on account’ or of paying in installments directly at the point of sale without an intermediary? By integrating a quick and straightforward credit standing assessment process, there should be nothing to prevent you from offering these possibilities.

AccountCheck enables additional payment options at the point of sale (POS). APIs can be implemented to provide access to a customer's financial data, such as account balance or credit standing. Merchants can use this method to verify that customers are able to pay the invoice before any goods are delivered.

If a customer wants to purchase an item at a POS, for example, but does not have a credit card or cash, the merchant can use AccountCheck to ask the customer's bank to verify the account balance or credit standing. If the bank confirms, the purchase can go ahead and be made on an invoice.